Schedule C Tax Form Printable

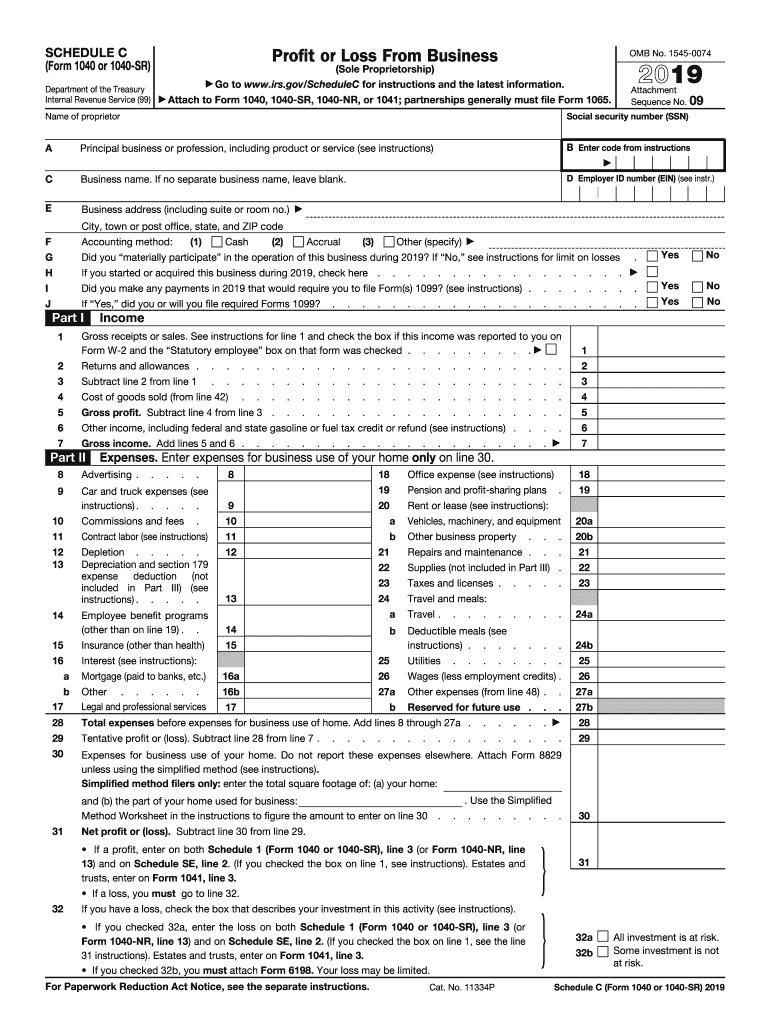

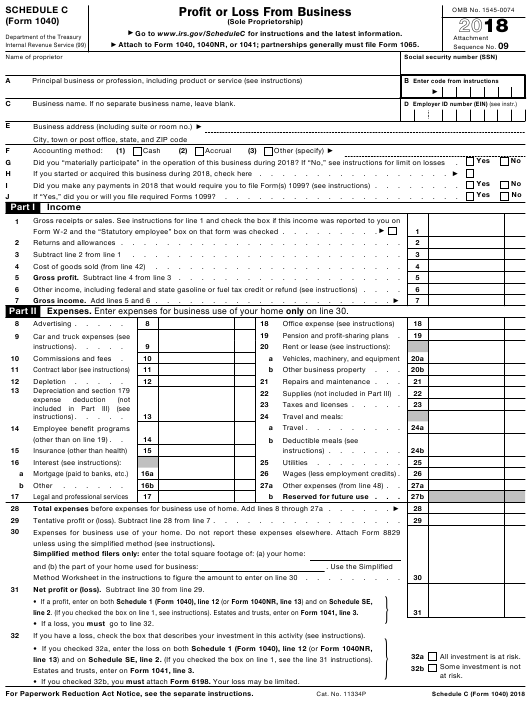

Schedule C Tax Form Printable - Web what is a schedule c? Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web a form schedule c: Web what is schedule c? How many schedule c forms do you need? Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web in 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. You fill out schedule c at tax time and attach it to or file it. Web february 22, 2023. Web what is a schedule c? Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web a form schedule c: Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Who needs to fill out schedule. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web what is schedule c? You fill out schedule c at tax time and attach it to or file it. Web irs schedule c, profit or loss from business, is a tax form you file with. You fill out schedule c at tax time and attach it to or file it. Web irs schedule c is a tax form for reporting profit or loss from a business. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. Web schedule c (form 1040) department of the treasury. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Sole proprietors have to prepare schedule c to report the income for the tax year and deductible expenses. Check out how easy it is to complete and esign documents online using fillable templates and a powerful. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web february 22, 2023. Sole proprietors have to prepare schedule c to report the income for the. Web february 22, 2023. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web in 2023, the income limits for all tax brackets and all filers will. This document also known as. How many schedule c forms do you need? Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web february 22, 2023. Web february 22, 2023. This document also known as. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web schedule c (form 1116) is used to identify foreign tax redeterminations that. Web what is schedule c? This document also known as. Web a form schedule c: Web february 22, 2023. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web what is a schedule c? Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. Web in 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Sole proprietors have to prepare schedule c to report the. Web in 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web irs schedule c is a tax form for reporting profit or loss from a business. Web irs schedule c, profit or loss from business, is a tax form you file with your form 1040 to report income and. How many schedule c forms do you need? Web what is a schedule c? You fill out schedule c at tax time and attach it to or file it. Who needs to fill out schedule c? This document also known as. Web a form schedule c: Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99). Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web february 22, 2023. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. Sole proprietors have to prepare schedule c to report the income for the tax year and deductible expenses. Web schedule c (form 1040) department of the treasury internal revenue service profit or loss from business (sole proprietorship). Web schedule c (form 1116) is used to identify foreign tax redeterminations that occur in the current tax year in each. Web what is schedule c? Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web option a involves completing form 8829, by calculating the total area of your home and getting a percentage for. Web schedule c (form 1040) department of the treasury internal revenue service (99) profit or loss from business (sole. You fill out schedule c at tax time and attach it to or file it. This document also known as. Web a form schedule c: Web in 2023, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table. Web schedule c (form 1040) 2015 profit or loss from business (sole proprietorship) department of the treasury internal revenue service (99). Web irs schedule c is a tax form for reporting profit or loss from a business. Web february 22, 2023. Who needs to fill out schedule c? Web what is schedule c? Sole proprietors have to prepare schedule c to report the income for the tax year and deductible expenses. Web use schedule c (form 1040) to report income or (loss) from a business you operated or a profession you practiced as a sole. Web what is a schedule c? How many schedule c forms do you need?IRS 1040 Schedule CEZ 20182022 Fill and Sign Printable Template

FREE 9+ Sample Schedule C Forms in PDF MS Word

FREE 9+ Sample Schedule C Forms in PDF MS Word

Free Printable Schedule C Tax Form Printable Form 2022

FREE 9+ Sample Schedule C Forms in PDF MS Word

IRS 1040 Schedule C 2019 Fill and Sign Printable Template Online

Schedule C Form 1040 How to Complete it? The Usual Stuff

It's Just Wrong Businesses Without Employees Qualify Too Alignable

FREE 9+ Sample Schedule C Forms in PDF MS Word

IRS Form 1040 Schedule C Download Fillable PDF Or Fill 2021 Tax Forms

Web Irs Schedule C, Profit Or Loss From Business, Is A Tax Form You File With Your Form 1040 To Report Income And.

Web Schedule C (Form 1116) Is Used To Identify Foreign Tax Redeterminations That Occur In The Current Tax Year In Each.

Check Out How Easy It Is To Complete And Esign Documents Online Using Fillable Templates And A Powerful Editor.

Web Schedule C (Form 1040) Department Of The Treasury Internal Revenue Service Profit Or Loss From Business (Sole Proprietorship).

Related Post: