Printable Itemized Deductions Worksheet

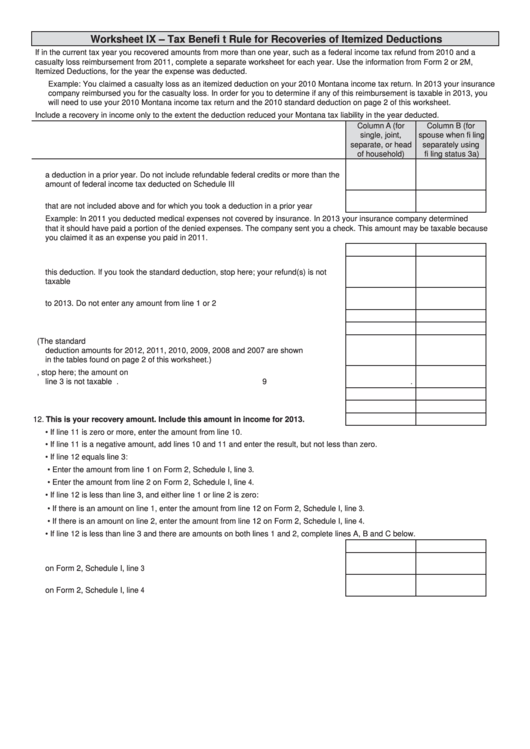

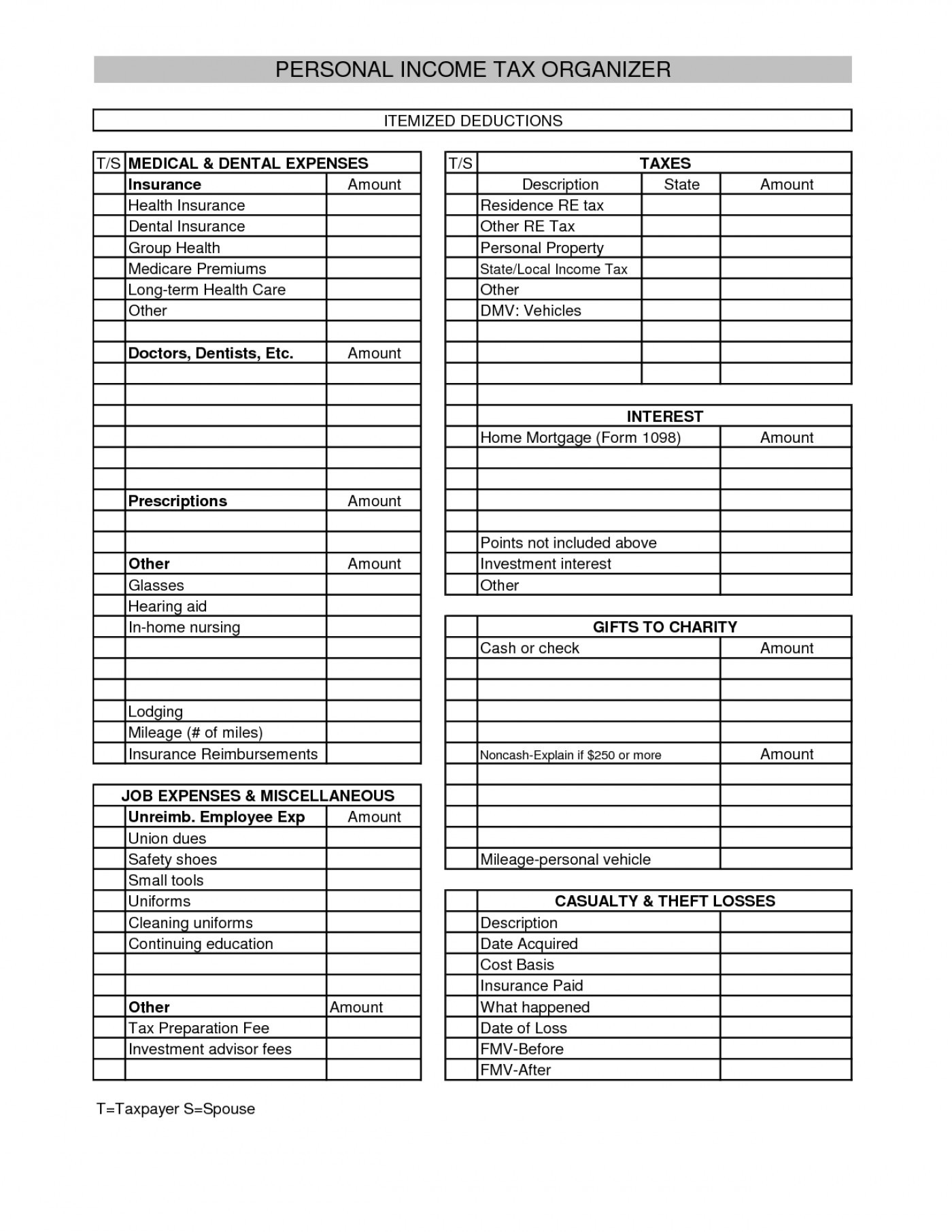

Printable Itemized Deductions Worksheet - $1,690 age 61 to 70: Use this worksheet to identify available deductions and tax. Easily fill out pdf blank, edit, and. Web you can also deduct certain casualty and theft losses. Open it up using the online editor and start altering. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web your itemized deduction expenses must exceed: Tax deductions for calendar year 2 0 ___ ___ marketing. Web find the list of itemized deductions worksheet you require. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. $450 age 41 to 50: Web find the list of itemized deductions worksheet you require. Web worksheet allows you to itemize your tax deductions for a given year. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments,. Easily fill out pdf blank, edit, and. $5,640 the limit on premiums is. Web worksheet allows you to itemize your tax deductions for a given year. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. At the end of this lesson, using your resource materials, you will be. $450 age 41 to 50: Web this schedule is used by filers to report itemized deductions. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions. Web use schedule a (form 1040) to figure your itemized deductions. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. After downloading the free template to your computer, you will automatically start on the first tab of the. Web complete printable itemized deductions worksheet online with us legal forms. Web worksheet allows you to itemize your tax deductions for a given year. Easily fill out pdf blank, edit, and sign. Web download our free 2022 small business tax deductions worksheet,. $450 age 41 to 50: Open it up using the online editor and start altering. • determine if a taxpayer should itemize deductions • determine the type of. Use this worksheet to identify available deductions and tax. Easily fill out pdf blank, edit, and sign. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. Web find the list of itemized deductions worksheet you require. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add. Web use schedule a (form 1040) to figure your itemized deductions. Web the itemized deduction for state. We will determine whether your total itemized deductions or the standard deduction for. Web find the list of itemized deductions worksheet you require. In most cases, your federal income tax will be less if you take. Web use schedule a (form 1040) to figure your itemized deductions. $1,690 age 61 to 70: Web your itemized deduction expenses must exceed: Open it up using the online editor and start altering. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments,. Tax deductions for calendar year 2 0. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions. Web you can also deduct certain casualty and theft losses. $4,520 age 71 and over: $5,640 the limit on premiums is. Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments,. Web worksheet allows you to itemize your tax deductions for a given year. Web how to use the itemized deductions checklist. Web we’ll use your 2022 federal standard deduction shown below if more than your itemized deductions above (if blind, add. $850 age 51 to 60: Web find the list of itemized deductions worksheet you require. Web complete printable itemized deductions worksheet online with us legal forms. We will determine whether your total itemized deductions or the standard deduction for. Web your itemized deduction expenses must exceed: Easily fill out pdf blank, edit, and. If you and your spouse paid expenses jointly and are filing separate returns for 2016, see pub. After downloading the free template to your computer, you will automatically start on the first tab of the. $5,640 the limit on premiums is. Web use schedule a (form 1040) to figure your itemized deductions. Web find the list of itemized deductions worksheet you require. Open it up using the online editor and start altering. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web this schedule is used by filers to report itemized deductions. Web age 40 or under: $1,690 age 61 to 70: Edit your itemized deductions worksheet online type text, add images, blackout confidential details, add comments,. Web the itemized deduction for state and local taxes and sales and property taxes is limited to a combined,. Tax deductions for calendar year 2 0 ___ ___ marketing. $4,520 age 71 and over: Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. (any one contribution of $250 or more needs written evidence) Web use schedule a (form 1040) to figure your itemized deductions. Web download our free 2022 small business tax deductions worksheet, and we’ll walk you through how to use it right. Web department of the treasury internal revenue service itemized deductions go to www.irs.gov/schedulea for instructions. $850 age 51 to 60: Web worksheet allows you to itemize your tax deductions for a given year. Web if you expect to claim deductions other than the standard deduction and want to reduce your withholding, use the deductions. If you and your spouse paid expenses jointly and are filing separate returns for 2016, see pub. Use this worksheet to identify available deductions and tax. Web the itemized deduction for state and local taxes and sales and property taxes is limited to a combined,. Web complete printable itemized deductions worksheet online with us legal forms. We will determine whether your total itemized deductions or the standard deduction for. $5,640 the limit on premiums is. Property taxes non cash contributions / donations medical &. Web complete printable yearly itemized tax deduction worksheet online with us legal forms. • determine if a taxpayer should itemize deductions • determine the type of. Easily fill out pdf blank, edit, and.California Itemized Deductions Worksheet

Itemized Deductions Worksheet 2018 Printable Worksheets and

5 Best Images of Itemized Tax Deduction Worksheet 1040 Forms Itemized

California Itemized Deductions Worksheet

8 Best Images of Tax Itemized Deduction Worksheet IRS Form 1040

Itemized Deductions Checklist Fill and Sign Printable Template Online

Itemized Deduction Worksheet How Many Tax Allowances Should You Claim

Itemized Deductions Worksheet —

Itemized Deductions Worksheet 2017 Printable Worksheets and

Haller Group AZ Tax Deduction Worksheet For Realtors Fill and Sign

Web How To Use The Itemized Deductions Checklist.

In Most Cases, Your Federal Income Tax Will Be Less If You Take.

Edit Your Itemized Deductions Worksheet Online Type Text, Add Images, Blackout Confidential Details, Add Comments,.

After Downloading The Free Template To Your Computer, You Will Automatically Start On The First Tab Of The.

Related Post: