Printable Independent Contractor 1099 Form

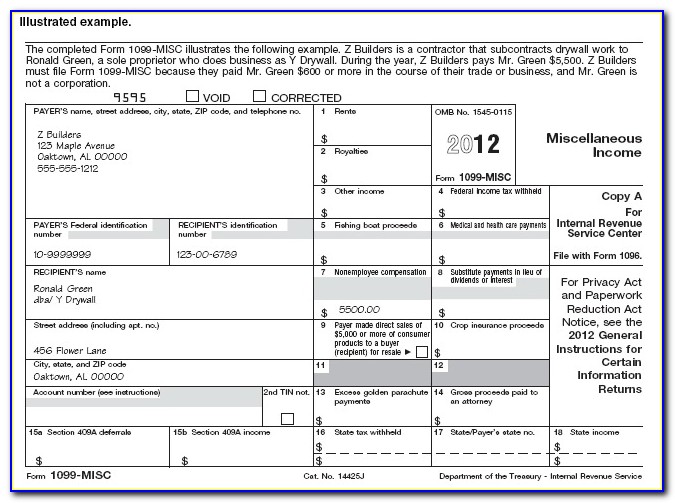

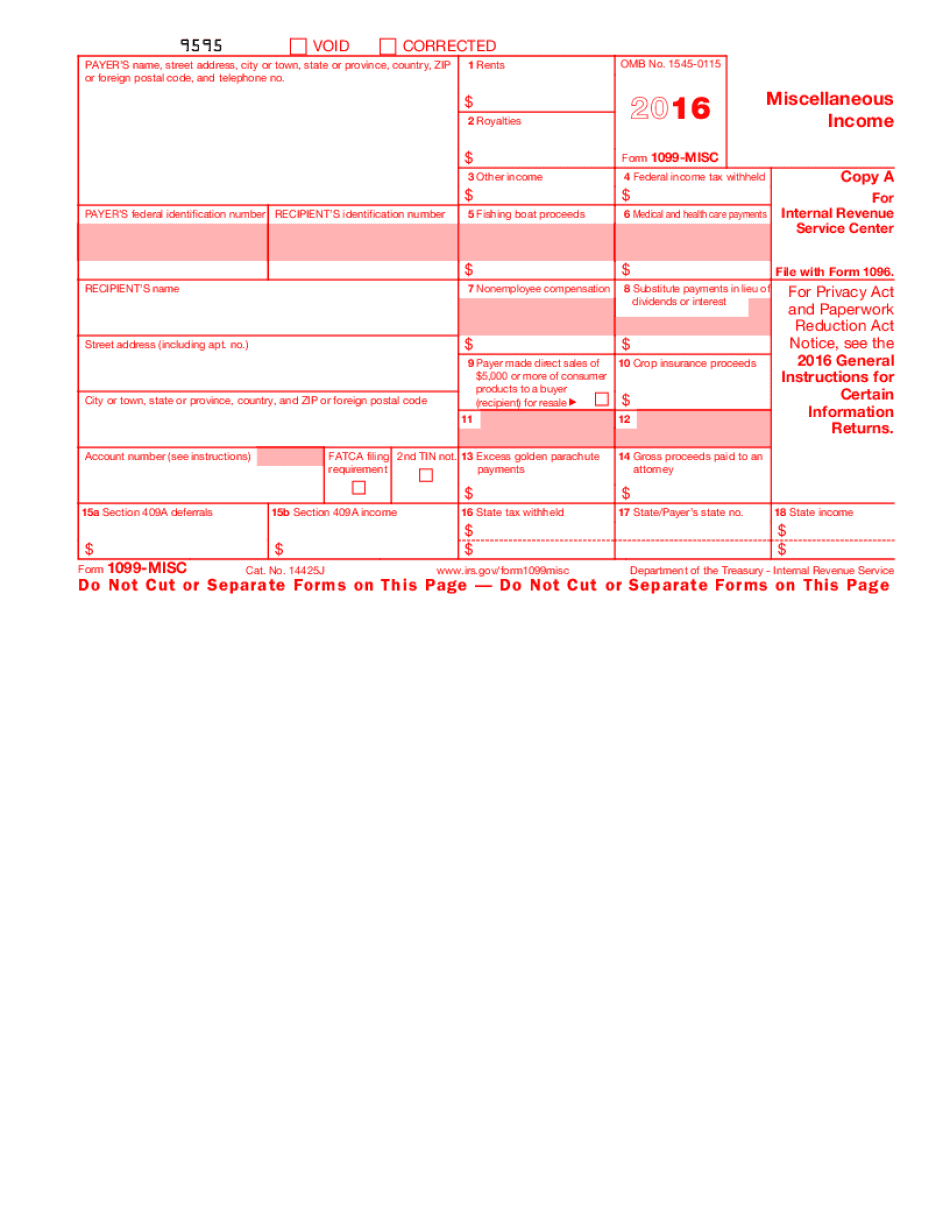

Printable Independent Contractor 1099 Form - Fill, sign and send anytime,. Web fillable 1099 form independent contractor. Web get start for free when do you consider an individual as 1099 contractor? At least $10 in royalties or broker. Web 22 rows the form is used to report payments to independent contractors, rental property income, income from interest and. Web isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year directly, you. There are late penalties for payer’s who file the information returns. There are 20 variants of 1099s, but the. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. A 1099 contractor is a person who works. Fill, sign and send anytime,. Web what is a 1099 independent contractor? Collection of most popular forms in a given sphere. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as. Web 22 rows the form is used to report payments to independent contractors, rental property income,. Web 22 rows the form is used to report payments to independent contractors, rental property income, income from interest and. Web fillable 1099 form independent contractor. Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. Web get start for free when do you consider an individual as 1099 contractor? Fill,. There are 20 variants of 1099s, but the. Report wages, tips, and other compensation paid to an. Web isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year directly, you. A 1099 contractor is a person who works. Web get start for free when do you consider an individual as 1099. Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. Web submit your form 1099 online to the irs by march 31st, 2021. Web get start for free when do you consider an individual as 1099 contractor? A person who contracts to perform services for others without having. A 1099 contractor. Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. A person who contracts to perform services for others without having. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. Collection of most popular forms in a given sphere. Report wages, tips, and other compensation. Web isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year directly, you. There are 20 variants of 1099s, but the. If payment to the independent contractor is more than $600 over the course of a. Web fillable 1099 form independent contractor. Fill, sign and send anytime,. Web 22 rows the form is used to report payments to independent contractors, rental property income, income from interest and. There are late penalties for payer’s who file the information returns. Collection of most popular forms in a given sphere. Web fillable 1099 form independent contractor. There are 20 variants of 1099s, but the. Web 22 rows the form is used to report payments to independent contractors, rental property income, income from interest and. A person who contracts to perform services for others without having. Report wages, tips, and other compensation paid to an. Web the 1099 form must be filed by january 31st of the year following the year in which you performed. There are 20 variants of 1099s, but the. Web isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year directly, you. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. Web submit your form 1099 online to the irs by march 31st, 2021. Report wages,. Fill, sign and send anytime,. Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. A 1099 contractor is a person who works. At least $10 in royalties or broker. Web what is a 1099 independent contractor? Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. Web submit your form 1099 online to the irs by march 31st, 2021. There are 20 variants of 1099s, but the. Web 22 rows the form is used to report payments to independent contractors, rental property income, income from interest and. Fill, sign and send anytime,. Web fillable 1099 form independent contractor. A 1099 contractor is a person who works. Collection of most popular forms in a given sphere. Web isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year directly, you. There are late penalties for payer’s who file the information returns. Web what is a 1099 independent contractor? If payment to the independent contractor is more than $600 over the course of a. A person who contracts to perform services for others without having. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as. This form is used by employers to report payments made to independent contractors or other. At least $10 in royalties or broker. Web get start for free when do you consider an individual as 1099 contractor? Report wages, tips, and other compensation paid to an. Web 22 rows the form is used to report payments to independent contractors, rental property income, income from interest and. Collection of most popular forms in a given sphere. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as. Web get start for free when do you consider an individual as 1099 contractor? There are late penalties for payer’s who file the information returns. Web isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year directly, you. A 1099 contractor is a person who works. There are 20 variants of 1099s, but the. Web what is a 1099 independent contractor? At least $10 in royalties or broker. Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. Report wages, tips, and other compensation paid to an. Web submit your form 1099 online to the irs by march 31st, 2021. A person who contracts to perform services for others without having. This form is used by employers to report payments made to independent contractors or other.1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

1099 Form Independent Contractor 2016 Pdf Universal Network

1099 Form Independent Contractor Pdf Independent Contractor Invoice

1099 Form Independent Contractor Pdf 1099 Tax Form Fill Online

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

1099 Form For Independent Contractors 2019 Form Resume Examples

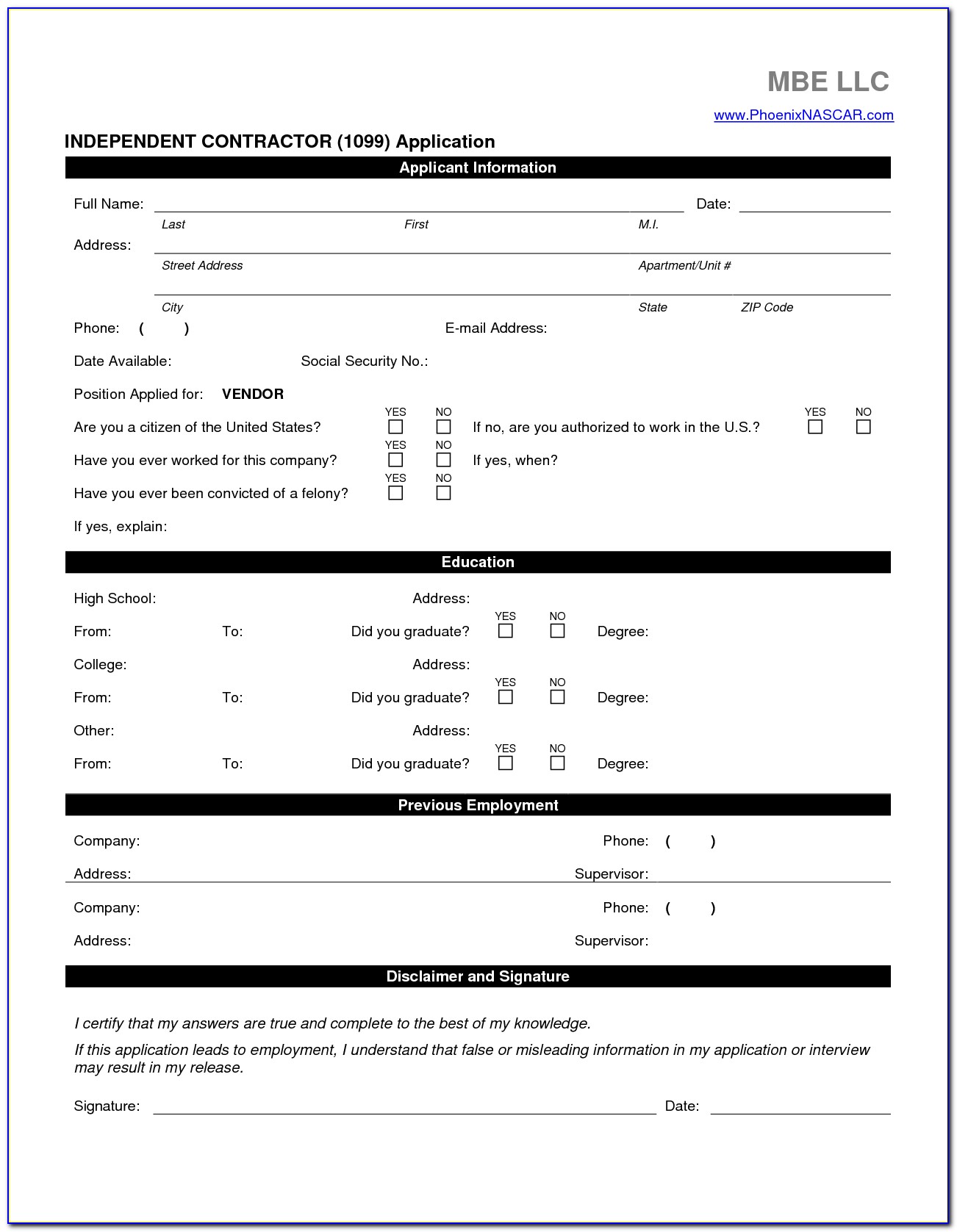

1099 Form Independent Contractor Pdf 40 Independent Contractor

1099 Tax Form Independent Contractor Universal Network

1099 form independent contractor Fill Online, Printable, Fillable

Free 1099 Forms For Independent Contractors Universal Network

Web Fillable 1099 Form Independent Contractor.

Web Independent Contractor (1099) An Independent Contractor Invoice Is Used By Anyone Independently Working For.

If Payment To The Independent Contractor Is More Than $600 Over The Course Of A.

Fill, Sign And Send Anytime,.

Related Post: