Printable 1099 Forms For Independent Contractors

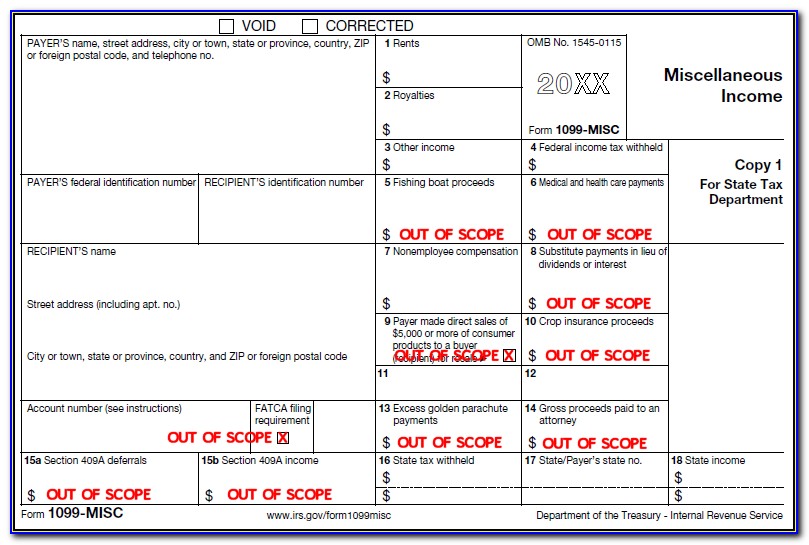

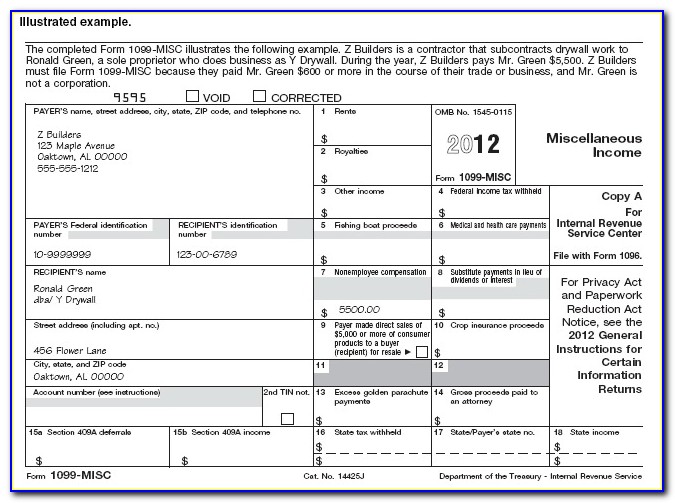

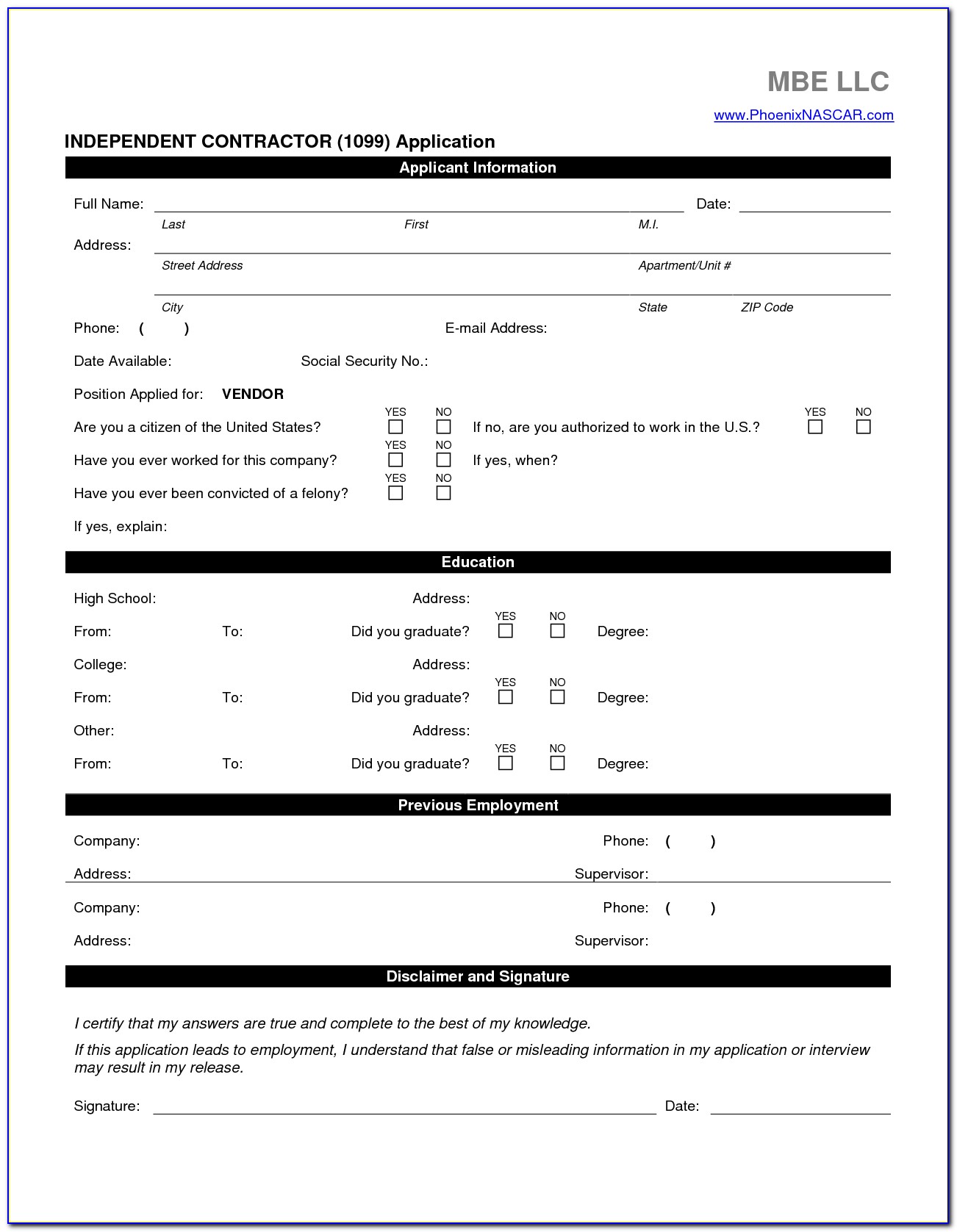

Printable 1099 Forms For Independent Contractors - Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. Web submit your form 1099 online to the irs by march 31st, 2021. Collection of most popular forms in a given sphere. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. Web fillable 1099 form independent contractor. Instead, they are reported using a 1099. There are late penalties for payer’s who file the information returns. If payment to the independent contractor is more than $600 over the course of a. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). For example, if you worked as an independent contractor in 2023, you would need to file your 1099 form by january 31st, 2022. If payment to the independent contractor is more than $600 over the course of a. Fill, sign and send anytime,. Web report payments of $10 or more made in the course of a trade or business in gross royalties or broker. Web the 1099 form must be filed by january 31st of the year following the year in which you. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Instead, they are reported using a 1099. There are late penalties for payer’s who file the information returns. We’ll let you know about form 1099 types of independent contractors. Fill, sign and send anytime,. There are late penalties for payer’s who file the information returns. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). If payment to the independent contractor is more than $600 over the course of a. A person who contracts to perform services for others without having. We’ll let you know about form 1099 types of independent contractors. For example, if you worked as an independent contractor in 2023, you would need to file your 1099 form by january 31st, 2022. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. Web fillable 1099 form independent contractor. A person who contracts to. Collection of most popular forms in a given sphere. We’ll let you know about form 1099 types of independent contractors. Web fillable 1099 form independent contractor. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web what is a 1099 independent contractor? Web fillable 1099 form independent contractor. Web report payments of $10 or more made in the course of a trade or business in gross royalties or broker. Web submit your form 1099 online to the irs by march 31st, 2021. For example, if you worked as an independent contractor in 2023, you would need to file your 1099 form by. If payment to the independent contractor is more than $600 over the course of a. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. Collection of most popular forms in a given sphere.. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. A person who contracts to perform services for others. We’ll let you know about form 1099 types of independent contractors. A person who contracts to perform services for others without having. Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. Web submit your form 1099 online to the irs by march 31st, 2021. Web the 1099 form must be. Web report payments of $10 or more made in the course of a trade or business in gross royalties or broker. For example, if you worked as an independent contractor in 2023, you would need to file your 1099 form by january 31st, 2022. If payment to the independent contractor is more than $600 over the course of a. A. Web fillable 1099 form independent contractor. If payment to the independent contractor is more than $600 over the course of a. Collection of most popular forms in a given sphere. There are late penalties for payer’s who file the information returns. Web if you would like the irs to determine whether services are performed as an employee or independent contractor,. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). For example, if you worked as an independent contractor in 2023, you would need to file your 1099 form by january 31st, 2022. Fill, sign and send anytime,. Web submit your form 1099 online to the irs by march 31st, 2021. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. Web report payments of $10 or more made in the course of a trade or business in gross royalties or broker. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. We’ll let you know about form 1099 types of independent contractors. Web what is a 1099 independent contractor? A person who contracts to perform services for others without having. Instead, they are reported using a 1099. Web what is a 1099 independent contractor? Web submit your form 1099 online to the irs by march 31st, 2021. Web independent contractor (1099) an independent contractor invoice is used by anyone independently working for. A person who contracts to perform services for others without having. Collection of most popular forms in a given sphere. If payment to the independent contractor is more than $600 over the course of a. Web www.irs.gov/form1099misc instructions for recipient recipient’s taxpayer identification number (tin). Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent contractor. For example, if you worked as an independent contractor in 2023, you would need to file your 1099 form by january 31st, 2022. Web fillable 1099 form independent contractor. There are late penalties for payer’s who file the information returns. Web report payments of $10 or more made in the course of a trade or business in gross royalties or broker.1099 Tax Form Independent Contractor Universal Network

1099 Form Miscellaneous Form Resume Examples K75PK8yDl2

1099 form independent contractor Fill Online, Printable, Fillable

1099 Form Independent Contractor 2018 Universal Network

Printable 1099 Form Independent Contractor Master of

1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

1099 Form For Independent Contractors 2019 Form Resume Examples

1099 Form Independent Contractor Pdf / 1099 Form Independent Contractor

We’ll Let You Know About Form 1099 Types Of Independent Contractors.

Fill, Sign And Send Anytime,.

Web If You Would Like The Irs To Determine Whether Services Are Performed As An Employee Or Independent Contractor,.

Instead, They Are Reported Using A 1099.

Related Post:

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)