Printable 1099 Form Independent Contractor

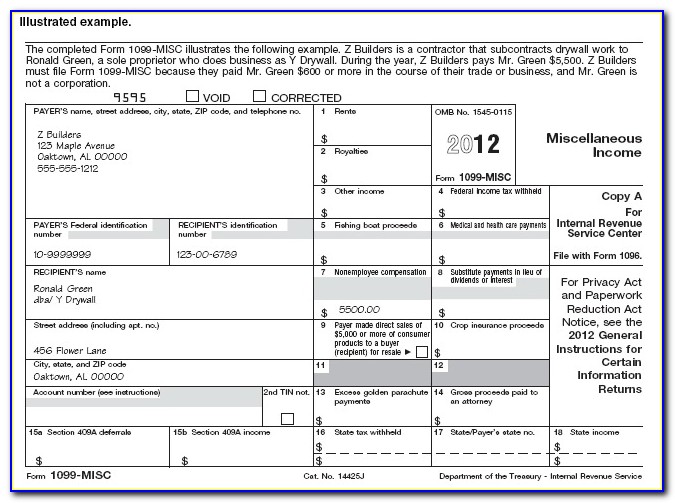

Printable 1099 Form Independent Contractor - There are late penalties for payer’s who file the information returns. Web what is a 1099 independent contractor? Web submit your form 1099 online to the irs by march 31st, 2021. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Web we have provided you the detailed information about different types of independent contractors who receive a. Completing and filing this tax form is. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. There are 20 variants of 1099s, but the. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. There are late penalties for payer’s who file the information returns. Completing and filing this tax form is. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. Simple instructions and pdf download updated: Web report payments made of at least $600 in the course. A person who contracts to perform services for others without having. Simple instructions and pdf download updated: There are 20 variants of 1099s, but the. Web we have provided you the detailed information about different types of independent contractors who receive a. Web in addition to the irs forms that an independent contractor must file, their clients and employers are. Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent. Web we have provided you the detailed information about different types of independent contractors who receive a. If payment to the independent contractor is more than $600 over the course of a. A person who. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. There are late penalties for payer’s who file the information returns. Web submit your form. Simple instructions and pdf download updated: Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. There are 20 variants of 1099s, but the. A person who contracts to perform services for others without having. If payment to the independent contractor is more than $600. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. A person who contracts to perform services for others without having. There are late penalties for payer’s who file the information returns. Web report payments made of at least $600 in the course of a. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Completing and filing this tax form is. Web we have provided you the detailed information about different types of independent contractors who receive a. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor. Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. Web we have provided you the detailed information about different types of independent contractors who receive a. A person who contracts to perform services for others without having. Web submit your form 1099 online to. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. There are 20 variants of 1099s, but the. Completing and filing this tax form is. Simple instructions and pdf download updated: A person who contracts to perform services for others without having. A person who contracts to perform services for others without having. There are late penalties for payer’s who file the information returns. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. There are 20 variants of 1099s, but the. Simple instructions and pdf download updated: Web march 29, 2023 reviewed by isaiah mccoy, cpa if you hired a contractor or freelancer and paid them more than $600 in a year. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. There are late penalties for payer’s who file the information returns. Web submit your form 1099 online to the irs by march 31st, 2021. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. A person who contracts to perform services for others without having. Simple instructions and pdf download updated: There are 20 variants of 1099s, but the. Web we have provided you the detailed information about different types of independent contractors who receive a. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for. If payment to the independent contractor is more than $600 over the course of a. Completing and filing this tax form is. Web what is a 1099 independent contractor? Web the 1099 form must be filed by january 31st of the year following the year in which you performed the work as an independent. Web submit your form 1099 online to the irs by march 31st, 2021. Web what is a 1099 independent contractor? Simple instructions and pdf download updated: There are late penalties for payer’s who file the information returns. Web in addition to the irs forms that an independent contractor must file, their clients and employers are required to submit information regarding. Web we have provided you the detailed information about different types of independent contractors who receive a. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. If payment to the independent contractor is more than $600 over the course of a. Completing and filing this tax form is. A person who contracts to perform services for others without having. Web an independent contractor invoice is used by anyone independently working for themselves to request payment for.1099 form independent contractor Fill Online, Printable, Fillable

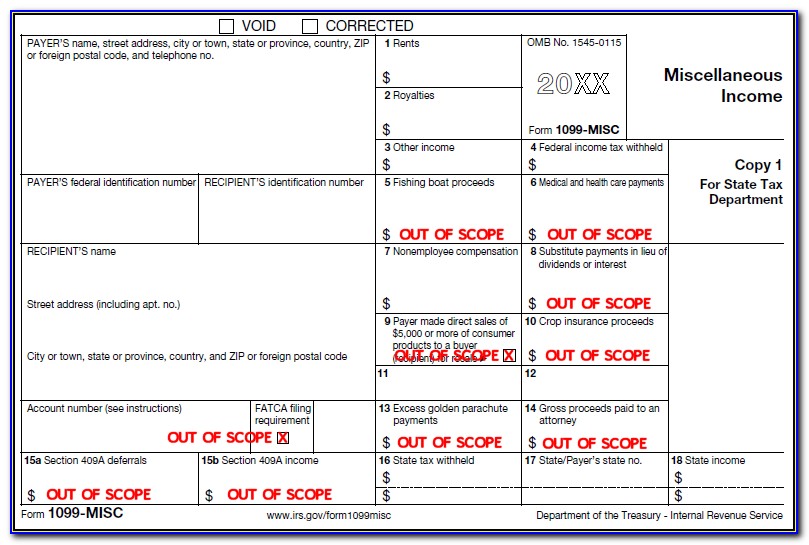

1099 Form Independent Contractor Pdf / Irs Form 1099 Misc Fill Out

1099 Form Independent Contractor Pdf Klauuuudia 1099 Misc Template

1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

1099 Form Independent Contractor Pdf / 1099 Form Independent Contractor

1099 Form Independent Contractor Pdf Independent Contractor Invoice

1099 Tax Form Independent Contractor Universal Network

1099 Form Independent Contractor Pdf 7 Excel 1099 form Template 93341

1099 Form For Independent Contractors 2019 Form Resume Examples

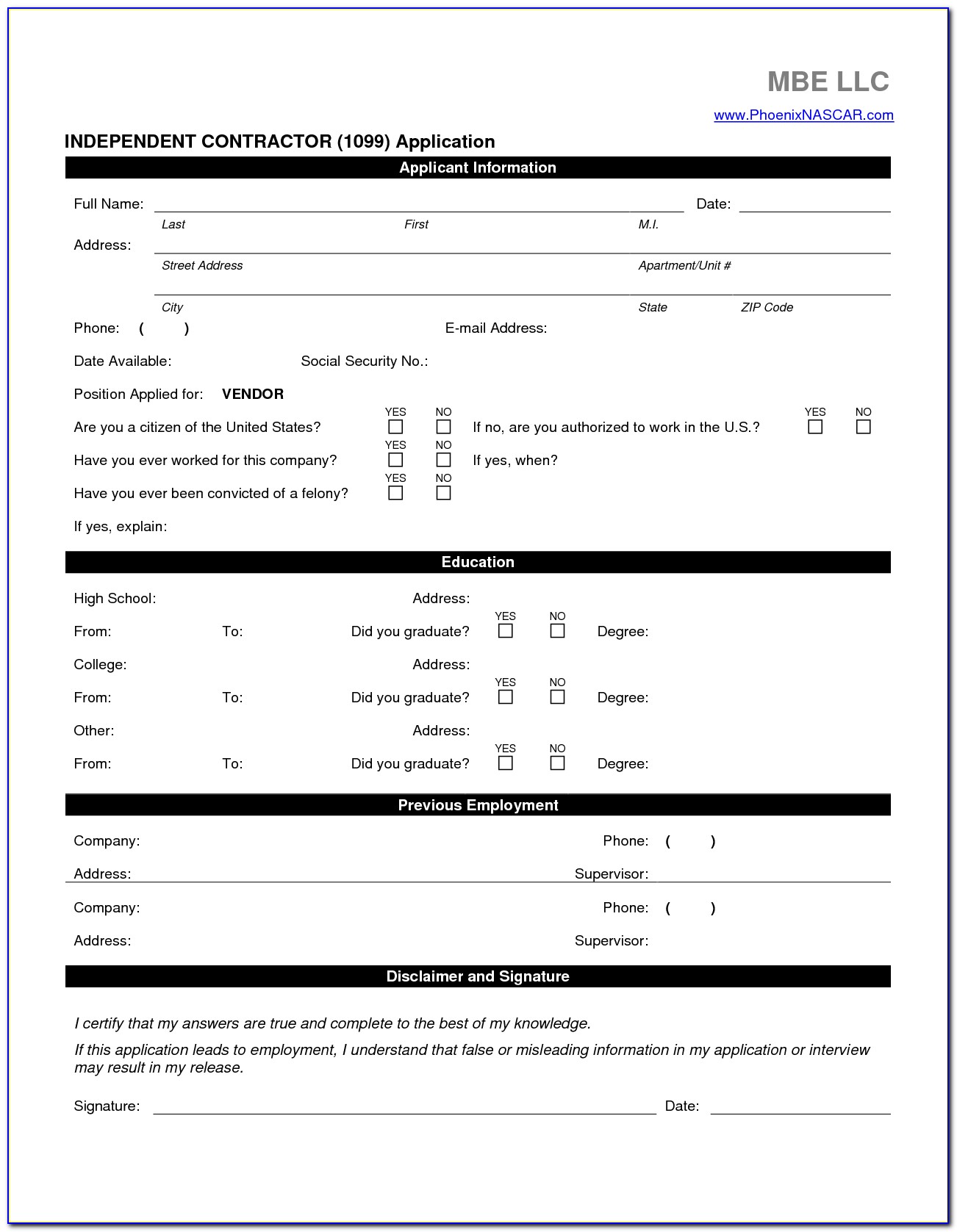

1099 Form Independent Contractor Pdf 40 Independent Contractor

Web March 29, 2023 Reviewed By Isaiah Mccoy, Cpa If You Hired A Contractor Or Freelancer And Paid Them More Than $600 In A Year.

Web The 1099 Form Must Be Filed By January 31St Of The Year Following The Year In Which You Performed The Work As An Independent.

There Are 20 Variants Of 1099S, But The.

Related Post:

:max_bytes(150000):strip_icc()/1099div-23bffa1db9074ba1b43bdd2cb4ece3ec.jpg)