Form 1099 Printable

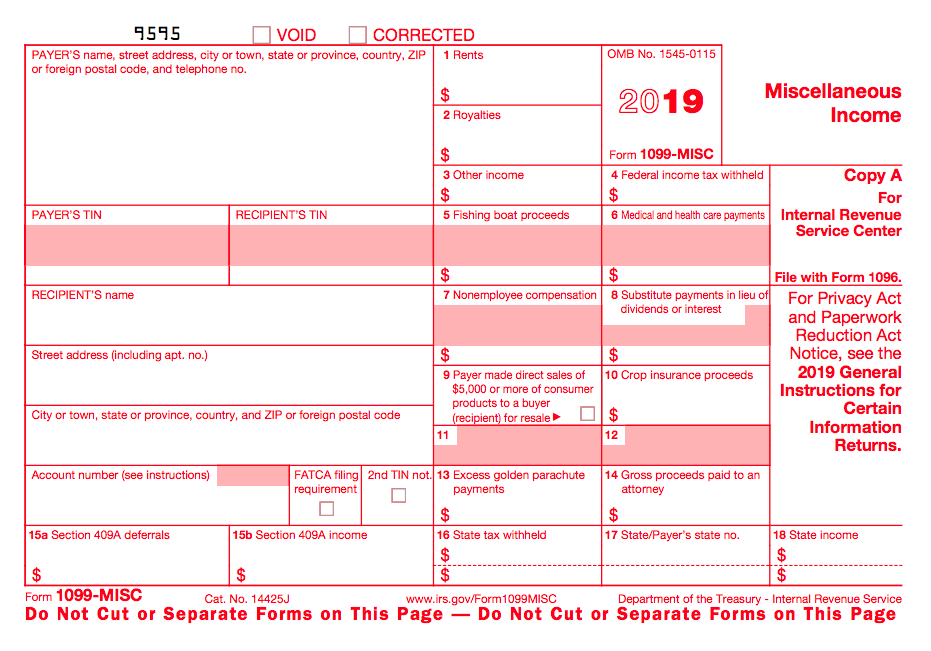

Form 1099 Printable - Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Box 11 includes any reporting under section 6050r, regarding cash payments for the purchase of fish for resale. Web here you can get form 1099 printable template and how to fill 1099 tax form for 2021. Eliminates common costly errors when. Copy a appears in red,. For your protection, this form may show only the. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Web select which type of form you’re printing: Effortlessly add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or remove. Web edit printable 1099 form. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Print out the blank 1099 form or fill it out online in a handy editor for free. Web the irs 1099 form is a collection of tax forms documenting different types of payments made by an individual. Web. Copy a appears in red,. Print out the blank 1099 form or fill it out online in a handy editor for free. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Web click the fill out form button to start filling out a 1099a form. Web see. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. There are different extensions for. For your protection, this form may show only the. Print out the blank 1099 form or fill. The left field of the form provides information about a lender and a. Web instructions for recipient recipient’s taxpayer identification number (tin). Web click the fill out form button to start filling out a 1099a form. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Web here you can get form 1099 printable. Web here you can get form 1099 printable template and how to fill 1099 tax form for 2021. Web instructions for recipient recipient’s taxpayer identification number (tin). Print out the blank 1099 form or fill it out online in a handy editor for free. Web edit printable 1099 form. Box 11 includes any reporting under section 6050r, regarding cash payments. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Web click the fill out form button to start filling out a 1099a form. Web instructions for recipient recipient’s taxpayer identification number (tin). Web select which type of form you’re printing: Web see irs publications 1141, 1167, and 1179 for more information about printing. Eliminates common costly errors when. Copy a of this form is provided for informational purposes only. Web select which type of form you’re printing: Effortlessly add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or remove. Box 11 includes any reporting under section 6050r, regarding cash payments for the purchase of fish for resale. Web get federal tax return forms and file by mail. Web select which type of form you’re printing: Print out the blank 1099 form or fill it out online in a handy editor for free. Web instructions for recipient recipient’s taxpayer identification number (tin). Copy a of this form is provided for informational purposes only. Get paper copies of federal and state tax forms, their instructions, and the address. Eliminates common costly errors when. Web get federal tax return forms and file by mail. Copy a of this form is provided for informational purposes only. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Eliminates common costly errors when. Box 11 includes any reporting under section 6050r, regarding cash payments for the purchase of fish for resale. Web get federal tax return forms and file by mail. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Web the irs 1099 form is a collection of tax forms. Box 11 includes any reporting under section 6050r, regarding cash payments for the purchase of fish for resale. Copy a of this form is provided for informational purposes only. Web get federal tax return forms and file by mail. For your protection, this form may show only the. The left field of the form provides information about a lender and a. Copy a appears in red,. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. There are different extensions for. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Print a sample by clicking “print sample on blank paper.” this will let. Web report payments made of at least $600 in the course of a trade or business to a person who's not an. Web select which type of form you’re printing: Web here you can get form 1099 printable template and how to fill 1099 tax form for 2021. Print out the blank 1099 form or fill it out online in a handy editor for free. Get paper copies of federal and state tax forms, their instructions, and the address. Effortlessly add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or remove. Web click the fill out form button to start filling out a 1099a form. Web edit printable 1099 form. Eliminates common costly errors when. Web instructions for recipient recipient’s taxpayer identification number (tin). The left field of the form provides information about a lender and a. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Print out the blank 1099 form or fill it out online in a handy editor for free. For your protection, this form may show only the. Web edit printable 1099 form. Copy a appears in red,. Web get federal tax return forms and file by mail. Print a sample by clicking “print sample on blank paper.” this will let. Web click the fill out form button to start filling out a 1099a form. Web here you can get form 1099 printable template and how to fill 1099 tax form for 2021. Effortlessly add and underline text, insert images, checkmarks, and signs, drop new fillable fields, and rearrange or remove. Eliminates common costly errors when. Get paper copies of federal and state tax forms, their instructions, and the address. Web see irs publications 1141, 1167, and 1179 for more information about printing these tax forms. Web report payments made of at least $600 in the course of a trade or business to a person who's not an.Irs Printable 1099 Form Printable Form 2022

Printable 1099 Tax Forms Free Printable Form 2022

Sample 1099 Letter To Vendors

Free Printable 1099 Form Free Printable

IRS Form 1099 Reporting for Small Business Owners

Blank 1099 Form Online eSign Genie

What Is a 1099 Form, and How Do I Fill It Out? Bench Accounting

Best Way To File Taxes With A 1099 Tax Walls

What is a 1099Misc Form? Financial Strategy Center

1099MISC Form Printable and Fillable PDF Template

Copy A Of This Form Is Provided For Informational Purposes Only.

Box 11 Includes Any Reporting Under Section 6050R, Regarding Cash Payments For The Purchase Of Fish For Resale.

There Are Different Extensions For.

Web The Irs 1099 Form Is A Collection Of Tax Forms Documenting Different Types Of Payments Made By An Individual.

Related Post: